Term Stacking

15/07/2025

Term stacking is a new term life insurance strategy developed here at The Term Guy. It takes advantage of some unique pricing structures in one company’s term life insurance policies (but can sometimes be extended into other companies’ term life insurance policies as well), along with a common term life insurance benefit – the exchange option. The result? Cheaper premiums on Term 20 and Term 30 life insurance AND a term that’s extended out to as long as 21 or 31 years (and still cheaper than straight term 20 or term 30).

How Term Stacking works

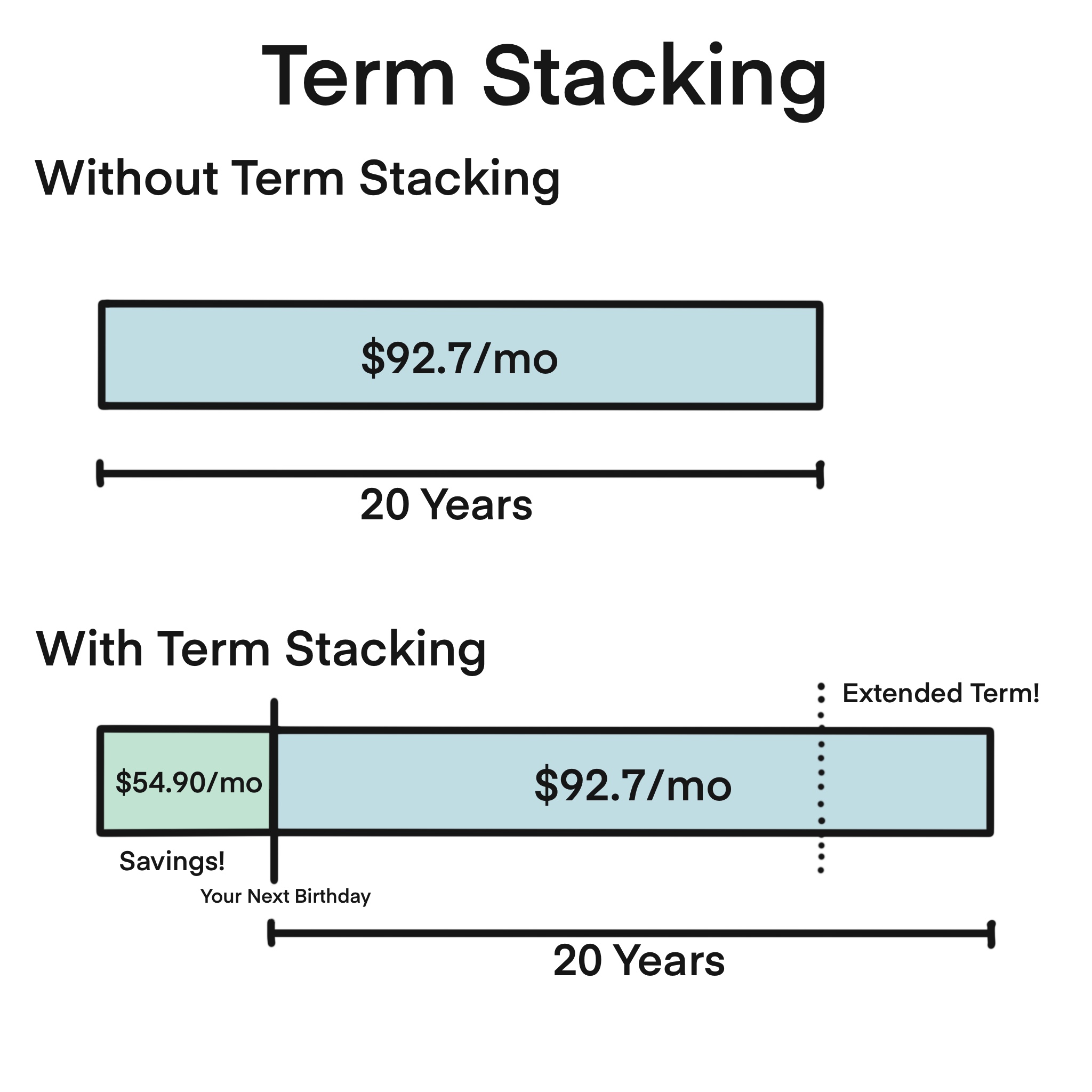

Lets say you’re looking for a term 20 or term 30 policy. You could purchase a straight term 20 or term 30, and have the associated level premiums and coverage for 20 or 30 years.

With term stacking, you purchase a term 10 policy instead, and then just prior to your next birthday, use the exchange option to switch your term 10 to a term 20 or term 30 policy. When you do the exchange, the premiums for the new term 20 or term 30 policy will be the same as if you’d purchased the policy today.

Savings at beginning of your policy

The effect of this is that you’re paying term 10 premiums until you’re next birthday. This could cut your premiums as much as in half or more, for as many months as you have until you turn a year older. Yes, it’s that easy and that substantial; up to almost your first year having your term 20 or term 30 premiums cut in half.

Benefits at the end of your policy

Your exchanged term 20 or term 30 policy starts when you do the exchange – you’re pushing out the start date of that level coverage out until your next birthday. That has two potentially very important benefits. First, pushing out the start date also pushes out the end date of that coverage, giving you additional coverage at the same term 20 or term 30 premiums at the end of the policy. i.e. If you just turned 40 and purchase a term 20, your coverage lasts until age 60. If you do term stacking, you purchase a term 10 and then just prior to your 41’st birthday you start a term 20. This new exchanged term 20 policy now lasts until almost age 61. Imagine having a term 20 policy and then at age 60 having the opportunity to keep the coverage at the same premiums for almost another year – something many people would be very interested in at that age.

Secondly this also pushes out the time frame for conversion to permanent. One of the primary reasons to convert from term to permanent is due to declining health. In the above example, you would have almost another full year between ages 60 and 61 to maintain your term 20 coverage, and that’s almost another full year for you to decide if you want to convert the term to permanent due to decreases in your health and insurability.

Why it works

We use Wawanesa’s term life insurance policies for our term stacking strategy. Their policies have a combination of three things that are unique in the industry:

Amongst the lowest term premiums in Canada, if not the lowest.

Exchange option available starting as soon as the policy is issued. Most companies require you to keep the policy in force for at least one year before you can use the exchange option.

Actual age for insurance premiums. Most companies use your nearest birthday for an age calculation, so if you’re 40.5 years old, you’re considered 41 for insurance purposes. Wawanesa maintains your age 40 until just prior to your next birthday. This means you can purchase a term 10 policy at age 40, and then just prior to your 41st birthday do the exchange and your new term 20 or term 30 policy will still be at age 40 premiums. Most other companies would increase your premiums on the new policy to be for someone aged 41 (that’s why with this strategy we can defer the exchange to just prior to your next birthday – you don’t have a premium increase before your next birthday).

Extensions on Term Stacking

It’s possible in some cases that extending the term stacking principle out for two years makes financial sense as well. This will very much depend on your age and coverage amount – we have to run these numbers individually for you (just ask!).

Caveats, risks and dangers

There’s a few non-guaranteed elements in this strategy that you should be aware of. It’s our appraisal that these non-guaranteed elements are very low risk, but you should always be aware that these elements exists.

First, the exchange option may not be available in the future. It’s possible that life insurance companies could withdraw this benefit. We feel that this is unlikely in a competitive environment, but the possibility exists.

Next, premiums on the term 20 or term 30 life insurance policy, when you do the exchange, could have increased (premiums in the future are not guaranteed for policies not yet issued). Life companies these days rarely do premium changes any more, at most every year or two, and Wawanesa has already done a price change in the last year. So we don’t expect any pending price changes on their term insurance. When companies do change their term rates, they’re often decreasing (which would make term stacking even better because the exchanged term 20 or term 30 policy will then have lower premiums than if you’d have purchased the policy today) so it’s unlikely there would be a premium increase. And, should there be a premium increase we generally have advanced notice, giving us enough time to implement any outstanding term stacking clients. Again, we fell this is very low risk – but it’s not zero risk. Sudden shifts of taxation or political legislation (none of which we know of that are pending, and any new ones would likely take years to implement) can have a dramatic increase on life insurance premiums.

Implementing term stacking

The implementation is easy – you simply apply for a term 10 instead of a term 20 or term 30 policy initially. Then just prior to your next birthday you complete a form with us that requires a signature, which will exchange your term 10 for a term 20 or term 30. It’s straight forward, saves you a lot of money, provides important additional benefits to your insurance decades in the future, and only takes one signature on a form.

We understand this can be a bit confusing but the premiums and additional benefits make this something you should investigate. If you’d like a personalized conversation, or quotes on this strategy, please call us at 416-642-6820.